How much does wedding insurance cost?

Since many factors influence the cost of a wedding and with a myriad of insurance companies offering different levels of coverage for various types of special event insurance, the answer isn’t relatively straightforward.

One thing is for sure: event insurance for your wedding will cost much less than any claim you are liable for, and the same goes for wedding cancellation insurance. That’s why you need to make sure you’re covered.

So, let’s look at types of wedding insurance, what it can cover, and how much you’ll pay for it.

Weddings cost a LOT. And you’re probably wondering why you must add the additional expense of wedding insurance to the overall wedding budget.

We admit it’s not the most exciting thing to get. But the truth is that a wedding insurance policy is as necessary as it is tedious. That being said, we’ll try to make this quick.

Wedding insurance is a specific type of insurance coverage that can protect you from certain events leading up to and on the wedding day, such as liquor liabilities, hazards, cancellations, etc. Wedding insurance policies don’t usually come with everything in mind, so staying informed is crucial to ensuring you get the right policies to be covered appropriately.

Without it, you will be left seriously out of pocket if the wedding, for example, is postponed or canceled, and you will face a massive bill if anyone decides to sue you for property damage or injury.

In short, a wedding insurance policy gives you peace of mind and protects your wallet.

Wedding insurance companies chiefly cover two key areas: liability and cancellation. Some more comprehensive policies may include coverage for things such as a wedding limousine or even a change of heart.

Remember, there are always coverage limits in place, so depending on the cost of the claim, you may or may not be covered for the full amount. Ergo, don’t let anyone near the 30-minute firework presentation, or better yet, maybe just skip it altogether.

If you’re found liable for any property damage or personal injury sustained during your ceremony and reception, then the special event liability insurance will have your back.

For example, if one of your guests overdoes the champagne and accidentally smashes a window, the insurance will protect you from the cost of the claim the venue makes for its repair.

Or if your 3rd cousin slips and sprains her ankle while dancing, you’ll be covered for their medical bills.

Cancellation coverage, typically a separate policy from event liability insurance, protects you if your wedding is postponed or canceled. However, the coverage only extends to reasons beyond your control, such as a vendor no-show, extreme weather, or if your chosen venue goes out of business and has to close.

If you or the bride decide to cancel on your own accord, you most likely won’t be covered. Situations like those require the less commonly known “change of heart insurance,” which, despite the name, would still require the wedding to be canceled a year in advance to be covered.

Those in the military or certain types of jobs may get called away at a moment’s notice. If this coincides with the wedding, the postponement/cancellation insurance will provide coverage.

This coverage could be included with the main policy or be included as a rider, so if you’re on call 24/7, keep an eye out.

Your wedding cancellation/postponement policy may cover this as standard or add it to the policy.

Special wedding attire coverage provides additional bridal gown and wedding suit coverage. This coverage protects it if lost or damaged on the days leading up to the wedding and if the shop where the attire is purchased goes out of business before you collect the items.

Paying a deposit for vendors such as the caterer, florist, and photographer is usual practice. But what happens if they go out of business, have to cancel on you, or fail to deliver what was promised?

In these circumstances, the postponement and cancellation insurance will cover you for what you have already paid the vendors.

Some insurers may even provide coverage for your wedding gifts if they are lost or damaged during the day of the wedding, but this is not a guarantee, so if you have some nieces and nephews with sticky fingers, make sure to add this rider to your policy.

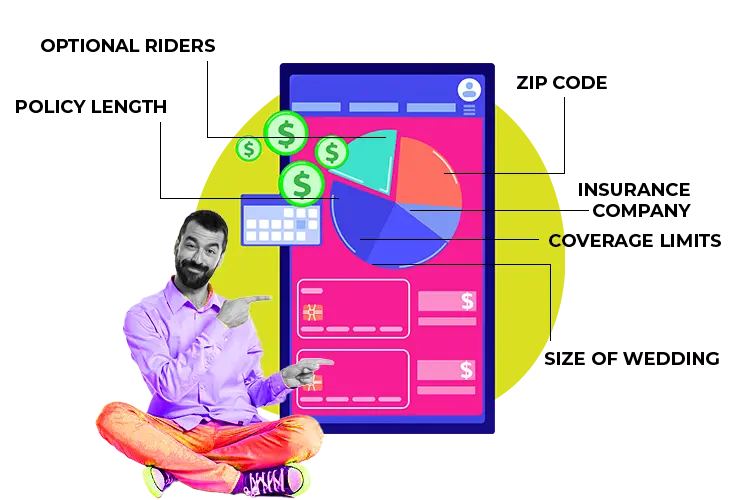

The cost of wedding insurance cover is not a “one-size-fits-all” approach. Complicated algorithms decide how much the insurance cost will be based on risk factors and the event coverage you need

Prices for wedding liability insurance can range from $120 to $300 for a $1 to $2 million limit policy. There may be separate charges for host liquor liability, medical payments, and other additional coverages not included in the base wedding event liability insurance.

Wedding cancellation and postponement policies typically range from $255 to $420, but of course, they can go much higher depending on how much you decide to spend. The range is based on the average wedding cost of around $30,000.

Is wedding insurance worth bringing down in price?

Not if it means reducing the coverage you require. Be honest about how much coverage you need; you will thank yourself if and when a claim is made.

However, if you want to reduce costs, the best way to do it is to research as many wedding insurers as possible to find which ones offer the best coverage for the lowest price.

Additionally, for a discount, see if you can bundle Wedding Event Liability insurance with Wedding Postponement/Cancellation insurance.

Cancellation and postponement insurance provides coverage if the wedding suffers cancellation and postponement for reasons beyond the wedding couple’s control. This is not to be confused with wedding event liability insurance, which covers what happens on the actual day of the wedding.

Certain companies offer wedding liability insurance up until the day before the wedding, however, this is not guaranteed. To best protect your finances, take out a wedding insurance policy when you make the first payment toward something wedding-related. If the insurance is purchased after everything else you might miss out on coverage for those purchases.

You should buy wedding insurance for your wedding. If an accident or property damage occurs during your wedding, or it is canceled or postponed, you could end up footing the bill. Wedding insurance will help protect you from each of these scenarios.

If you have wedding insurance and a wedding is canceled or postponed for reasons beyond your control, then your wedding insurance policy should provide reimbursement for this. You will be liable for the costs if the wedding is canceled due to a personal decision.

Purchasing wedding insurance isn’t exciting, but for a few minutes of your time (most policies can be bought online) and a couple of hundred dollars, is it worth risking the cost of your wedding or the possibility of a liability claim? We think not.

At The Groom Club, our job is to ensure all our readers are fully informed about what they can do to have a perfect day and not lose out financially. We have loads of ideas about overall budgeting, planning a wedding on a small budget, everything you need to know about destination weddings, and much, much more.

Subscribe to our newsletter and catch all our articles when they’re hot off the press!