An item that should be on all couple’s wedding planning checklist is a wedding insurance policy. It’s one of the less glamorous parts of planning the event. Still, it’s just as essential as the ceremony and reception.

Wedding insurance is a valuable safeguard against unforeseen circumstances impacting your special day. It’s vital for couples with a limited budget, where extra out-of-pocket expenses could derail the event. Can you really take the hit if something goes awry and you end up financially liable?

We’ve thoroughly analyzed all the top providers to bring you our definitive list of the best wedding insurance companies for 2024.

Wedding insurance is like a safety net for your big day, covering two main areas: liability and cancellation. Think of liability insurance as a must-have for most weddings, required by about 75% of venues.

It’s there to help cover costs if something goes wrong, like an accident during your celebration. Then there’s cancellation insurance, which is your backup plan if you need to postpone or cancel the wedding for reasons beyond your control. It helps you get back money you’ve already spent.

Together, these insurances help make sure that unexpected problems don’t spoil your special day or leave you out of pocket. But where do you get it, and who offers the best wedding insurance coverage?

Why we chose it:

Markel is a trusted name in the insurance world, so you can be assured you’re getting reliable coverage. If you opt for cancellation and liability coverage together, you are awarded a 15% discount.

| Pros | Cons |

|

|

Coverage:

Price for typical $1M/$2M liability policy = $160

Price for a $25,000 cancellation policy = $235

Markel is both the insurer and the carrier and is a specialty insurer founded in 1930. Besides wedding insurance, it covers classic cars, farms and horses, yachts, and more for standard and hard-to-place risks. Its dedication to providing top-notch customer service sets it apart from other insurers.

Markel’s wedding insurance covers the US, including US territories, Canada, the UK, the Bahamas, the Caribbean (excluding Cuba), Bermuda, and Mexico.

We are fans of the flexible cancellation coverage limits. Still, it needs to be clarified when getting a quote that there is a $25 deductible for items such as gifts, special attire, etc.

We had trouble with the online quote system and were never emailed our quote. Therefore, we recommend calling for one instead. The customer service team is helpful and responsive.

How To Get It?

Add your event location in the space provided here, click “Get a Quote,” and you will be taken to the online quote form.

Why we chose it:

Wedding Protector has a whopping ten levels of coverage available, including loss or damage for your wedding attire and jewelry. This makes it a perfect option for destination weddings where losing items in transit is more likely.

| Pros | Cons |

|

|

Coverage:

Price for typical $1M/$2M liability policy = $200

Price for a $25,000 cancellation policy = $255

Wedding Protector’s coverage is provided by Travelers – one of the longest-standing wedding insurance providers.

Operational since 1864, it has become a trusted brand capable of withstanding the test of time. Providing coverage for locations abroad and on US soil, Travelers has become the go-to insurer for destination weddings.

We like that there are zero deductibles no matter which of the ten levels of coverage you opt for. Although this is fantastic, it would be nice to have the option to include a deductible in exchange for a lower premium.

As well as the US, Wedding Protector’s coverage includes all US territories (excluding Alaska, Hawaii, and Louisiana), Puerto Rico, Canada, Bermuda, The Bahamas, Turks and Caicos, The Caribbean Islands (excluding Cuba and Haiti), the UK, and more.

The detailed coverage for loss and damage is especially beneficial for destination weddings

as you’re pretty much covered should your luggage happen to go wandering off, never to be

seen again.

How To Get It?

Wedding Protector is offered via protectmywedding.com. Click to start an online

quote – it only takes a few minutes.

Why we chose it:

Wedsure is – according to them – the inventor of wedding insurance! They specialize in this area and have honed their policy to provide plenty of customization options for coverage that fits like a glove.

| Pros | Cons |

|

|

Coverage:

Price for typical $1M/$2M liability policy = $125

Price for a $25,000 cancellation policy = $318

Established in 1995, Wedsure was the first to provide wedding insurance policies to cautious brides and grooms. WedSure’s carrier is Allianz – a global player in insurance and a reliable and financially stable organization.

We’re disappointed that WedSure is limited to the US and Canada. However, it must still be a top option if you plan to marry in these locations.

Coverage includes the ceremony, reception, rehearsal, and rehearsal dinner. And it’s one of the few insurance coverages to have cancellation due to a “change of heart.”

The sheer number of customization options gives you precision coverage, paying for exactly what you need. For example, if the wedding dress costs $2,435, you can have that specific coverage amount.

We also like the range of deductible options for each coverage price, enabling you to bring the premium down further.

The premium is displayed at the top of the quote screen and changes in real-time, so you can adjust the coverage settings until you get the price you want.

How To Get It?

Head to the Wedsure website and choose your liability coverage limit. Click “Continue,” and you’ll see the full quote page. Policies can be bought online right away.

Why we chose it:

Event Helper includes liquor liability coverage as standard, so you don’t have to pay extra. This can be beneficial even for dry weddings where someone may sneak in alcohol, and you end up liable.

| Pros | Cons |

|

|

Coverage:

Price for typical $1M/$2M liability policy = $126

Price for a $25,000 cancellation policy = $360

Event Helper has been providing wedding insurance since 2009; its carrier is Evanston Insurance Company.

The company specializes in weddings and events. We’ve found it’s a perfect option for those holding smaller weddings and looking for a lower-cost option.

We also found that it is one of the few wedding insurance providers that has a specific option for cannabis. While the policy won’t cover cannabis-related incidents or cannabis product liability, you will, however, be permitted to serve or sell cannabis without being penalized on the event insurance liability policy.

On the downside, Event Helper only provides coverage for events in the US. We found the application process unnecessarily long, and a few questions it asks could be more straightforward.

However, you can always call for a quote instead, and the website has an extensive FAQ section, which we found really helpful.

How to get it?

Head to the Event Helper website and follow the online application process. Alternatively, call (855) 493-8368 or email [email protected].

When it comes to wedding insurance, there are many choices. The most important thing for us is to balance getting decent and adequate coverage and not paying through the nose for it.

Some might say you can’t put a price on peace of mind, but we disagree. There’s no point getting an expensive insurance policy if it only makes you stress about the money you’ve spent on it. After all, aren’t weddings expensive enough?

That’s why we chose Markel as our top wedding insurance provider.

Okay, so it doesn’t have the level of customization as some other insurers on our list, but it does provide exceptional value. Markel charges very reasonable premiums without compromising quality, which is most important.

When researching which wedding insurers to include on our list, we looked at reputation, reliability, cost, and the level of coverage. Choice of coverage limits, wedding location, and optional extras also played a vital role in our decision-making.

We thoroughly tested each provider’s quoting system where possible to understand how it worked, what coverage was available, and the resulting premium.

For an unbiased review, we have taken the time to highlight the negatives and positives to provide you with enough information to make an informed decision about which coverage will suit your circumstances.

It’s no secret that weddings are one of life’s most significant expenses. Still, even the most meticulously planned day can face unexpected problems.

Wedding insurance is an umbrella term that references two separate coverages – liability and cancellation.

Wedding liability insurance is a periodic policy covering only the 24-48 hours of your event, including the rehearsal, rehearsal dinner, ceremony, reception, and sometimes the post-wedding brunch.

Liability insurance covers both general liability and property damage.

Sometimes, liability insurance includes coverage for medical payments and no-fault coverage that pays for medical bills if one of your guests is injured.

In essence, this policy will protect you from any lawsuits, accidents, or injuries at any events related to your ceremony.

Some examples of claims for liability insurance include:

Not only is wedding liability insurance a smart purchase but it’s typically required by the venue. By contrast, most venues require liability insurance with $1 million per occurrence limits and $2 million aggregate.

Suppose you purchase and serve alcohol independently without a caterer or professional bartender. In that case, you must also provide host liquor liability coverage. If you have a professional bartender or caterer serving alcohol, their insurance will cover liquor liability.

Lastly, the venue may also require something called a “subrogation waiver” or “primary non-contributory wording.” The two are interchangeable, but both state that even if the venue is liable for any incident, you cannot file an insurance claim against the venue’s policy.

You may pay more for coverage if you purchase host liquor liability coverage or a subrogation waiver.

The best wedding insurance will provide the coverage you need for peace of mind so you can go ahead and plan your wedding knowing you are protected if the worst occurs.

You may consider a wedding cancellation policy to supplement your wedding liability policy.

Wedding cancellation insurance is optional and covers non-refundable expenses if you cancel or postpone your wedding.

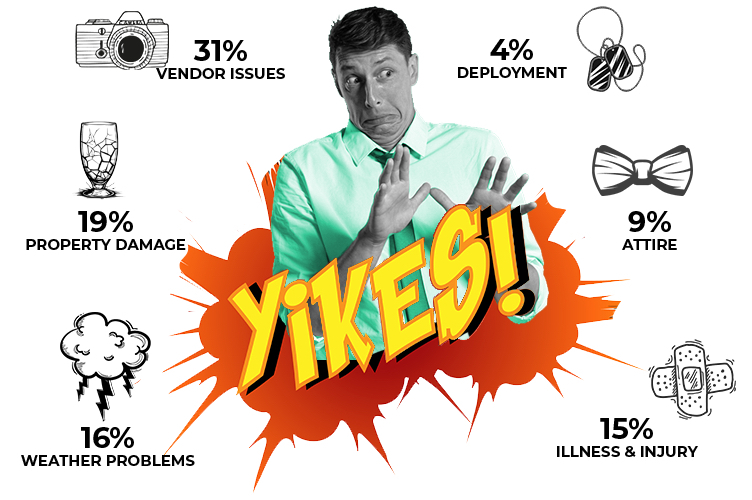

The price is based on the amount of coverage you select. While the cancellation coverage doesn’t cover cold feet or a change of heart, it does cover incidents like

Wedding cancellation insurance also covers

A typical wedding insurance cost for liability coverage is about $125, while a cancellation policy can cost over $200. However, the actual price depends on the size of your wedding, where it is being held, and the levels of coverage you opt for.

Wedding cancellation insurance is worth it for the peace of mind it gives. You never know what the future holds, and if the wedding has to be canceled or postponed through no fault of your own, then you can be left seriously out of pocket if you don’t have a policy in place.

Wedding insurance is similar to event insurance, but there are some differences. For example, wedding insurance can cover wedding-specific items such as gifts, special attire, and wedding photography. On the other hand, event insurance will provide coverage in a more general fashion.

WedSure is one of the few wedding insurance providers to offer coverage for a change of heart.

So there you have it. The Groom Club has scoured the internet to find the best wedding insurance companies, so you don’t have to!

We’re confident that the insurers on this list provide excellent quality, excellent coverage, and – most crucially – peace of mind.

Although Markel is our top recommendation, there may be a better fit for you. Therefore, we recommend using the online quoting systems for each provider until you find “the one!”