After investing your hard-earned dollars into a top-notch venue, gourmet catering, and a show-stopping cake, there’s no room for unexpected chaos. Enter wedding insurance, your trusty sidekick for warding off financial pitfalls and ensuring a memorable, worry-free celebration. This special event insurance can help protect you no matter what happens — whether Mother Nature interrupts your outdoor ceremony plans or one of your vendors pulls a vanishing act.

In this article, we’ll walk you through everything you need to know about wedding event insurance, including what it covers, what it doesn’t, and most importantly, how much it costs. By the end, you’ll be ready to make an informed decision about safeguarding your special day.

In case you haven’t heard, hosting a wedding is expensive. The figures are changing constantly, but last we checked, the average cost of a wedding was $30,433. With substantial sums dedicated to venue rentals, catering, and, of course, that all-important cake, insurance can help safeguard your investments.

Wedding insurance is a special event insurance designed to protect you from unforeseen circumstances that could otherwise drain your finances. In other words, wedding event insurance serves as a financial safeguard, providing peace of mind as you prepare for your big day.

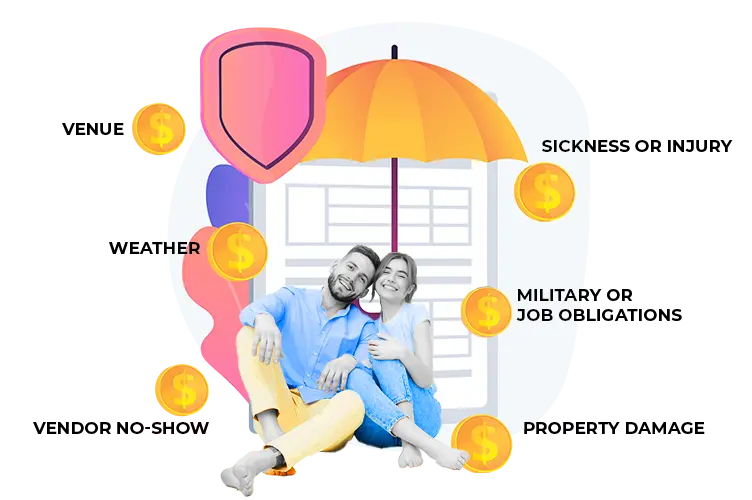

There are two main types of wedding insurance coverage: liability and cancellation. Like other insurance policies, wedding liability insurance protects you in case accidents result in injuries or property damage. Should something happen, your insurance provider shoulders the financial burden, covering all eligible expenses up to coverage limits.

On the other hand, cancellation coverage functions as a financial safety net when unforeseen events force cancellation or postponement of your wedding plans. This coverage extends to unexpected scenarios, such as no-show vendors, adverse weather conditions, or a serious illness with the bride, groom, or an immediate family member. In some instances, it even safeguards your wedding-related assets, including, but not limited to, the wedding dress and precious photographs.

We already discussed what wedding insurance covers in the last section; however, it’s helpful to see specific examples to help you understand what kind of protection you’ll be paying for. Remember that coverage varies from insurance company to insurance company, so make sure to research to find a policy that meets your needs.

Let’s talk about liability insurance first. Wedding liability insurance comes standard on all plans and is often required by venues. It covers property damage and guest injuries during the event. Say a wedding guest slips and falls on the dance floor, requiring emergency medical treatment. Liability coverage will pay their medical bills up to the policy limits.

Moving onto cancellation insurance, here are some common wedding insurance claims that are typically covered:

Venue: Wedding insurance provides protection in the event of damage or inaccessibility to the site. For example, your policy helps cover non-refundable deposits if your reception venue becomes unusable due to a fire or an electrical outage. Some policies may also cover damage to the rehearsal dinner venue.

Weather: Unpredictable weather conditions that prevent essential individuals like the couple, immediate family, or wedding party members from reaching the wedding location are included in most policies. This coverage includes rescheduling the wedding, including ceremony flowers, tent rentals, and catering. It’s worth noting that most states require you to purchase weather coverage at least 14 days in advance.

Vendor No-Show: It’s a sad and brutal truth that caterers, photographers, and officiants sometimes flake out on weddings. These no-shows can lead to postponement or even cancellation of the wedding. When that happens, wedding insurance covers the cost of rescheduling.

Sickness or Injury: Most wedding insurance plans provide some protection against illness or injury affecting the couple or their immediate family members (parents, siblings, grandparents, and children). Be aware that pre-existing medical conditions and COVID-19-related illnesses may not be covered. We recommend checking with insurance companies to understand the policies’ full scope.

Military or Job Obligations: Unforeseen military deployments or last-minute corporate relocations can disrupt wedding plans. Should that happen, insurance may cover the postponement of the wedding. With that said, it’s essential to review the policy beforehand carefully.

Property Damage: Some plans, like Allstate Wedding Event Insurance, include coverage against damage or theft of the wedding dress, tuxedo, gifts, and photographs as part of the cancellation coverage. Others, like Progressive’s Event Helper wedding insurance, offer this coverage as an add-on service.

While wedding event insurance provides a safety net for all kinds of unforeseen circumstances, there are plenty of scenarios it doesn’t cover. Here’s a closer look at what might not be included in your wedding insurance policy:

Change of Heart: Wedding insurance generally won’t reimburse past expenses or cancellation fees if the bride or groom decides to call off the wedding due to cold feet or a change of heart. One notable exception is Wedsure, but coverage must be purchased at least 15 months in advance.

Vendor Errors: Mistakes with your wedding cake typically aren’t covered by wedding insurance. These issues are considered vendor errors and should be addressed with the vendor directly.

Equipment from External Providers: Liability coverage often protects equipment rented from the venue but doesn’t usually cover damage to equipment rented from outside companies.

engagement rings and Non-Wedding Jewelry: Wedding insurance typically does not extend to jewelry like engagement rings or other personal items unrelated to the wedding. However, some policies may cover “special jewelry,” so be sure to read the fine print on what exactly that covers.

Risky Activities: Weddings involving extreme sports, petting zoos, firearms, or other high-risk activities may not be eligible for coverage.

Additional Exclusions: Common exclusions include injuries or damages from self-inflicted injuries, military operations, and hazardous sporting activities. Minor weather problems on the event day, like rain, may not be covered.

Given just how many exclusions there are, it’s essential to review the terms and conditions of potential policies and discuss any specific concerns or requirements with your insurance agent to ensure you have the appropriate coverage for your unique wedding plans.

The cost of wedding liability insurance and wedding cancellation insurance varies widely and is influenced by several factors. One of the significant considerations is the size of your event, including the number of attendees. On top of that, the duration of the event and the coverage level you select can affect the overall cost.

According to Briteco, wedding liability insurance costs $155 to $600, and wedding cancellation insurance costs $255 to $420 for the average wedding.

A note regarding these prices: the price quoted is typically a one-time payment, something that simplifies budgeting for your special day. However, it’s essential to be aware that some plans include deductibles, primarily in cases related to cancellation and damage claims. These deductibles can impact out-of-pocket expenses when making a claim, so ensure you understand a plan’s ins and outs before committing.

While we’re huge proponents of purchasing wedding insurance (especially for large and expensive gatherings), it’s not a one-size-fits-all solution. If you’re planning an intimate, budget-friendly ceremony, you might skip this type of insurance altogether.

It’s worth looking into your existing insurance policies before purchasing additional coverage. For instance, your auto, homeowners, or renters insurance may cover things like rental cars and personal liability. Moreover, you may be able to count on credit cards to reimburse lost deposits. Ultimately, it’s up to you to assess your situation and comfort level when deciding how to protect your big day.

Wedding insurance can help protect your deposits and is very affordable. Based on these two features alone, wedding insurance more than pays for itself. Still, it’s a good idea to check with the venue and your vendors about their coverage type. It’s also worth looking into your insurance plans to see if they offer protection for special events.

As with many aspects of wedding planning, the sooner you purchase insurance, the better. In fact, most companies allow you to enroll up to two years before your wedding date. You may not need to plan that far ahead, but it’s wise to purchase insurance as soon as you start paying deposits.

Wedding insurance companies like WedSafe, Wedsure, and Markel cover some destinations. That said, you should check the list of destinations, as only some countries will be included. For instance, Wedsure offers property coverage in Australia and Ireland. In contrast, liability coverage is only available in the United States, Canada, Puerto Rico, and the US Virgin Islands.

By now, you’ve discovered the importance of safeguarding your special day with wedding event insurance. But you probably also realize that protecting your investments is just one piece of the wedding planning puzzle.

Here at The Groom Club, we’re ready to assist you in putting all of the details together. So, whether you need help organizing your bachelor party or planning a surprise honeymoon, we have all the resources you need. For even more need-to-know tips, subscribe to our email newsletter.