Getting married is an exciting time, but it can also be a costly one. With all the costs associated with your big day, it can be difficult to figure out how to finance your wedding, and without proper knowledge, it can become a huge financial burden. This article will provide you with some of the top ways to finance your wedding, so you can have the perfect day without breaking the bank. From budgeting and saving tips to creative ways to raise money, you’ll find everything you need to know to make your special day a reality.

The most obvious reason is that there are costs associated with hosting a gathering of people. This includes the venue, catering, decorations, and other items that are necessary for the big day.

Additionally, many couples choose to hire vendors such as photographers, videographers, and florists, which can add up wedding costs quickly. Finally, weddings can be expensive because of tuxedos and other clothing that has to be purchased.

However, there are ways to save money on wedding expenses without sacrificing the quality of the event. Couples can keep their guest list small, look for bargains on clothing and decorations, and even consider hosting a wedding at home instead of a more expensive venue.

The key is to make a detailed budget and stick to it. Start by listing all of the items you need to purchase for the wedding and assign a cost to each one. This will help you to see where your money is going and how much is left in your budget.

Once you have a budget, it’s important to stick to it. You may be tempted to splurge on certain items, but if it’s not in the budget, then don’t do it. It’s also a good idea to shop around for the best prices and look for deals and discounts.

Finally, remember to factor in unexpected wedding expenses, such as last-minute changes or unexpected costs. With careful planning and budgeting, you can stay within your wedding budget and still have the perfect wedding day.

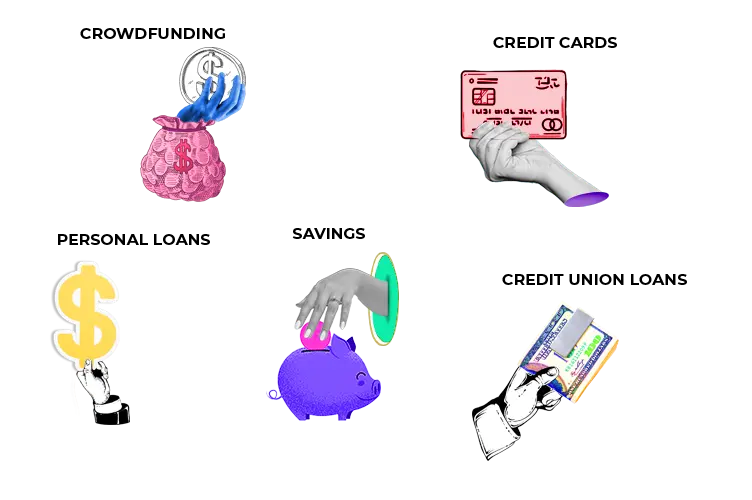

Planning a wedding can be expensive, but there are a few ways to finance it, including the following.

For many couples, this is an attractive option because it eliminates the need to take out a personal loan or use a credit card for the costs associated with their big day.

However, it’s important to remember that if you are financing your wedding with savings, it may take longer to build up a cushion for future needs such as a down payment on a house or car.

But if you are disciplined and have the funds available, financing your wedding with savings can be a great way to make your special day even more memorable.

This can be a great way to cover the wedding costs without having to dip into your savings. However, it’s important to be aware of the potential risks and rewards that come with such a decision.

On the positive side, using a credit card to finance your wedding can help you build credit, earn rewards points, and even save money on interest if you pay off the balance quickly. On the other hand, it can also lead to costly debt if you are unable to pay off the balance on time.

Therefore, it’s important to weigh the risks and rewards before deciding if a credit card is the right choice for you.

If you’re thinking of using crowdfunding (GoFundMe, Kickstarter, etc.) to finance your wedding, there are a few things to keep in mind. First, you’ll need to be creative with your campaign and make sure you’ve created a compelling story that will draw people in. You’ll also need to set a realistic funding goal, as well as provide rewards for those who contribute.

Moreover, make sure your crowdfunding campaign is properly promoted. You’ll need to spread the word on social media and other online platforms, as well as reach out to family, friends, and colleagues.

Crowdfunding can be a great way to finance a wedding, but it’s important to remember that it isn’t a guaranteed source of funding. So it’s important to have a backup plan in place in case your campaign doesn’t reach its goal.

Credit unions offer low-interest loans you can use to finance your wedding. These loans also typically have more flexible loan terms than traditional banks, which can make it easier to manage your payments.

Plus, credit unions are owned by members, so they often provide more personal services (and better rates) than other financial institutions.

When applying for a wedding loan , make sure to shop around and compare different credit unions to find the best rate and terms. Also, make sure to read the fine print and understand the loan amount and terms and conditions before signing any paperwork.

Personal loans are unsecured, meaning you don’t need to provide any collateral to get one. This makes them an ideal option if you need to borrow money for a short period of time, such as for a wedding.

Additionally, personal loans usually offer lower interest rates than credit cards, so they can be a more cost-effective way to finance your big day

However, it is important to note that taking out personal loans means you will be responsible for paying them back, so make sure you understand the terms and conditions of the loan and the monthly payments before you sign any paperwork. If you have a poor credit score it might not be the best idea to take out a personal loan, however if you have an excellent credit score this is definitely an avenue you can explore.

Generally, it is estimated that the average cost of a wedding in the United States in 2023 could be about $29,000

Still, you want to know the average cost of a wedding in 2023 is difficult to predict, as many factors can influence the cost. In general, the cost of a wedding depends on the size and location of the wedding, as well as the type of venue, food and beverages served, decorations, and entertainment. For example, a larger wedding in a larger city such as New York or Los Angeles will likely be more expensive than a smaller wedding in a smaller city.

Additionally, the cost of a wedding can vary depending on the season and the day of the week; weddings on Saturdays in the summer tend to be more expensive than weddings on Fridays in the winter.

The amount you should save depends on your budget and how much you are able to save each month. Generally, it is recommended that you save at least 10% of your total wedding budget, which can be anywhere from $10,000 to $50,000 or more, depending on your plans.

This means that if you are planning a $20,000 wedding, you should be aiming to save at least $2,000 each month. Of course, this is just a guideline – you may choose to save more or less, depending on your individual circumstances.

Additionally, you should also factor in any extra costs such as honeymoon, wedding insurance, and any hidden fees you may incur. Ultimately, it’s important to come up with a realistic budget and savings plan that works for you and your partner.

It depends on a variety of factors such as the type of food you’re serving, the number of guests, and the length of the reception.

Generally, it is recommended that you provide at least 2-3 ounces of food per person for hors d’oeuvres and 4-6 ounces of food per person for a buffet. For a sit-down dinner, aim for 3-4 ounces of protein (such as chicken, beef, or fish) plus 2 side dishes per person

If you are having a dessert course, plan for 1-2 desserts per person. It is also a good idea to have some extra food available in case of extra guests or unexpected dietary restrictions.

First, ask for help from family and friends. They may be able to contribute items or services that would otherwise require extra money.

Then, even if you’re working with a limited budget, invest in quality materials and decorations, such as luxurious linens, handmade centerpieces, and elegant lighting. This will create an atmosphere of elegance and luxury without stretching your wallet.

Additionally, invest in a local professional photographer. This will ensure you have beautiful memories of your special day that you can cherish for years to come without breaking the bank.

Finally, try to focus on quality over quantity when it comes to food and drinks. Serve fewer dishes, but make sure they are made with quality ingredients. This will help you create a memorable and luxurious wedding experience, without breaking the bank.

Financing your wedding is no easy feat – it takes a lot of planning and research to determine the best way to cover wedding costs. Fortunately, there are many options available to you – personal savings, family contributions, wedding loans, crowdfunding, credit cards, etc.) and you can find the right option for you and your partner.

Explore our website for more info on your wedding journey. We have countless resources, including groom hacks, to help make your groom’s experience unforgettable! Follow us on Instagram and TikTok as well.