Too many people put off getting insurance for their fine jewelry (especially engagement rings) thinking that jewelry insurance will be too expensive, they put it off, or they simply don’t know how easy it can be to protect some of your most valuable possessions. Don’t worry, it can be easy and affordable and we can help guide you.

A lot of people think if they have homeowners insurance, their valuable jewelry is covered. What they don’t realize is that most homeowners insurance has coverage limits for personal possessions such as jewelry—typically $1,000 or $2,000 (and they are also usually subject to deductibles). Any jewelry worth more than $1,000 should be insured with a standalone jewelry insurance policy.

You might be surprised at how reasonable jewelry insurance cost can be given the amount of coverage you get for your precious possessions. A stand alone jewelry policy costs about one to two percent of your jewelry item’s value. That means insurance for a $5,000 engagement ring would cost about $50 to $100 per year depending on where you live.

With those understandings in mind, let’s compare what you can get for your insurance dollar. We’ve looked at dozens of insurance companies and have selected the best insurance for jewelry for you to consider. And yes, we do have a favorite, so we’ll start there.

We rate BriteCo jewelry and watch insurance as the best option for comprehensive, all risk jewelry insurance. We choose BriteCo because it specializes only in jewelry insurance and it checks all the right boxes for top-notch insurance that beats any competitor. For the groom in particular, there is peace of mind that they are recognized by organizations like Brides and Martha Stewart for “Best Overall Engagement Ring Insurance.”

Lavalier is another specialty jewelry insurance company. Lavalier offers standard coverage and pricing; however, they offer a range of discounts for having a home safe, a home alarm system, as well as a gemstone grading report from a recognized organization such as the GIA. There’s also discounts if you keep your jewelry in a bank vault or a safe deposit box.

Lavalier appears to have a mediocre satisfaction rating among customer reviews. Lavalier premium costs may be somewhat higher than other competitors if you want to get a no deductible policy.

GemShield is a specialty jewelry insurance company that allows you to get a quote in just a few seconds without providing any personal information, and you can speak to an agent by phone if you need help. It was difficult for us to find more than a handful of customer reviews online. While a sales receipt is all you need to get coverage on a jewelry item under $5,000, over that amount you need an appraisal.

Jewelers Mutual is the incumbent specialized jewelry insurance company, having been around for one hundred years. It started out insuring retail jewelry stores and eventually branched into personal jewelry insurance.

You just need to supply a zip code and estimated value to get an initial quote on a piece of jewelry, and you don’t necessarily need to provide a jewelry appraisal to get coverage. Jewelers Mutual offers AM Best A+ rated coverage, deductible plans to help reduce premium costs, and works with your local jeweler for replacements.

JIBNA offers a stand-alone jewelry insurance policy through an authorized JIBNA insurance broker who can provide a quote. It specializes in insuring high value and antique jewelry as long as each piece can be properly appraised.

The appraisal provides for an agreed upon insured value and can result in higher premiums than standard replacement policies. If you need to make a claim on a JIBNA policy, you can either contact a representative by telephone or fill out the claims form directly online.

Chubb is an insurance company that specializes in insuring high-value properties and personal items including jewelry. That means its premium costs are typically higher than most competitors. You have to contact an insurance agent to get a quote and policy since Chubb doesn’t offer online quotes, or let you apply for a policy online. It offers discounts for a home safe and a burglar alarm.

Occasionally you may be able to save some money on insurance costs with a major carrier such as State Farm if you “bundle” homeowners and auto insurance. However, higher value jewelry insurance is usually treated as a separate floater policy at additional cost with its own deductible options.

That’s because homeowners policies typically limit coverage on personal items like jewelry to $1,000 to $2,000 subject to your homeowners deductible. It’s also important to recognize that a jewelry claim on a homeowners floater is recorded and reported to third party services that rate your risk with insurance companies.

Making a jewelry claim could jeopardize your homeowners or auto policy renewal. BriteCo, for example, does not report claims to any third party services so making a claim would not impact your homeowners policy.

| Company | Rating | Price | Customer Satisfaction/ Reviews | Coverage | Preventive Maintenance | High Value Item Surcharge | Home Safe & Burglar Alarm Discount |

|---|---|---|---|---|---|---|---|

| BriteCo | Best comprehensive, all risk jewelry insurance | 0.5% to 1.5% of appraised value | 4.9 in Google ratings | Up to 125% of the insured limit | Included | No | Yes, 5% for each |

| Lavalier | Best for discounts | 1.0% to 2.0% | 2.7 out of 5 Consumer Affairs | Up to 100% of insured limit | Not Included | Yes, starting at $15,000 or $30,000 | Yes, 5% for each |

| GemShield | Best for quick quotes | 1.0% to 2.0% | Few customer reviews available | Up to 100% of insured limit | Not Included | No | No |

| Jewelers Mutual | Best for no appraisals | 1.0% to 2.0% | 4.2 in Google ratings 3.9 Consumer Affairs | Up to 100% of insured limit | Included | Yes, starting at $15,000 or $30,000 | Yes, 5% for each |

| JIBNA | Best for antiques | 1.0% to 2.0% | Few customer reviews available | Up to 100% of insured limit | Not Included | Yes, starting at $15,000 or $30,000 | No |

| Chubb | Best for high-value items over $150,000 | 1.5% to 2.5% | Few customer reviews available for jewelry coverage | Up to 150% of insured limit | Not Included | Not Included Yes, starting at $100,000 | Yes, 5% for home safe, 10% for burglar alarm |

| State farm | Best for bundling | 1.0% to 2.0% | 3.4 out of 5 for homeowners policies | Up to 100% of insured limit | Not Included | Yes, starting at $25,000 | Yes, 15% for burglar alarm |

| Company | BriteCo |

|---|---|

| Rating | Best comprehensive, all risk jewelry insurance |

| Price | 0.5% to 1.5% of appraised value |

| Customer Satisfaction/ Reviews | 4.9 in Google ratings |

| Coverage | Up to 125% of the insured limit |

| Preventive Maintenance | Included |

| High Value Item Surcharge | No |

| Home Safe & Burglar Alarm Discount | Yes, 5% for each |

| Company | Lavalier |

|---|---|

| Rating | Best for discounts |

| Price | 1.0% to 2.0% |

| Customer Satisfaction/ Reviews | 2.7 out of 5 Consumer Affairs |

| Coverage | Up to 100% of insured limit |

| Preventive Maintenance | Not Included |

| High Value Item Surcharge | Yes, starting at $15,000 or $30,000 |

| Home Safe & Burglar Alarm Discount | Yes, 5% for each |

| Company | GemShield |

|---|---|

| Rating | Best for quick quotes |

| Price | 1.0% to 2.0% |

| Customer Satisfaction/ Reviews | Few customer reviews available |

| Coverage | Up to 100% of insured limit |

| Preventive Maintenance | Not Included |

| High Value Item Surcharge | No |

| Home Safe & Burglar Alarm Discount | No |

| Company | Jewelers Mutual |

|---|---|

| Rating | Best for no appraisals |

| Price | 1.0% to 2.0% |

| Customer Satisfaction/ Reviews | 4.2 in Google ratings 3.9 Consumer Affairs |

| Coverage | Up to 100% of insured limit |

| Preventive Maintenance | Included |

| High Value Item Surcharge | Yes, starting at $15,000 or $30,000 |

| Home Safe & Burglar Alarm Discount | Yes, 5% for each |

| Company | JIBNA |

|---|---|

| Rating | Best for antiques |

| Price | 1.0% to 2.0% |

| Customer Satisfaction/ Reviews | Few customer reviews available |

| Coverage | Up to 100% of insured limit |

| Preventive Maintenance | Not Included |

| High Value Item Surcharge | Yes, starting at $15,000 or $30,000 |

| Home Safe & Burglar Alarm Discount | No |

| Company | Chubb |

|---|---|

| Rating | Best for high-value items over $150,000 |

| Price | 1.5% to 2.5% |

| Customer Satisfaction/ Reviews | Few customer reviews available for jewelry coverage |

| Coverage | Up to 150% of insured limit |

| Preventive Maintenance | Not Included |

| High Value Item Surcharge | Not Included Yes, starting at $100,000 |

| Home Safe & Burglar Alarm Discount | Yes, 5% for home safe, 10% for burglar alarm |

| Company | State farm |

|---|---|

| Rating | Best for bundling |

| Price | 1.0% to 2.0% |

| Customer Satisfaction/ Reviews | 3.4 out of 5 for homeowners policies |

| Coverage | Up to 100% of insured limit |

| Preventive Maintenance | Not Included |

| High Value Item Surcharge | Yes, starting at $25,000 |

| Home Safe & Burglar Alarm Discount | Yes, 15% for burglar alarm |

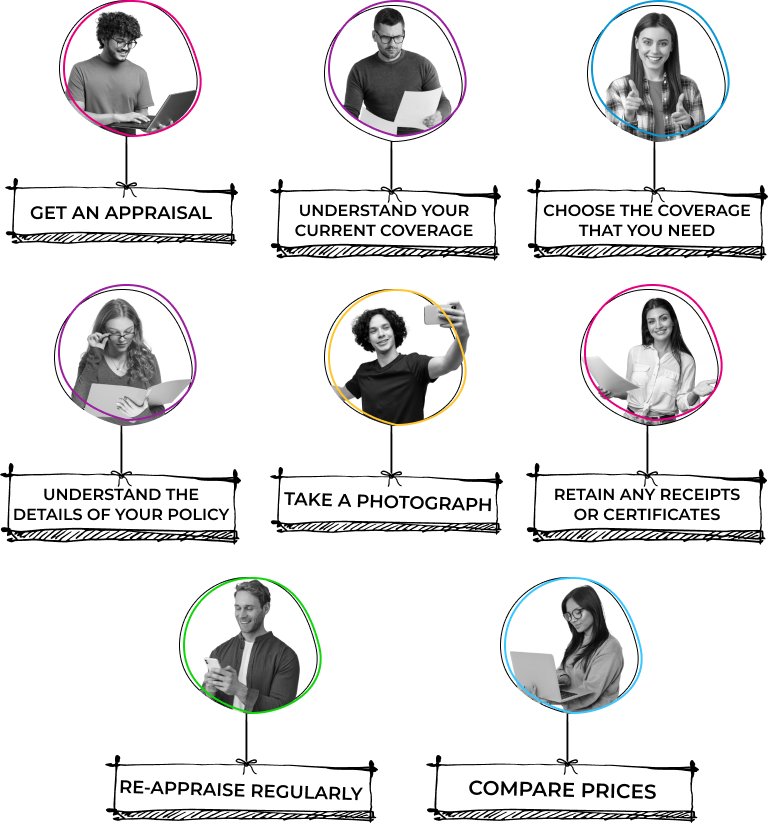

When shopping for the right jewelry insurance policy, there are several key things to keep in mind to ensure you get the best coverage:

Engagement ring insurance is probably the most popular type of jewelry insurance that many younger people consider getting, given its one of the major purchases in their life up to that point. Brides magazine, for example, agrees with our assessment and rates BriteCo number one overall for best engagement ring insurance.

When it comes to insuring jewelry, it’s better to be safe than sorry. Now that you understand how jewelry insurance works, you can make an informed decision about whether it’s worth it for you. Remember, while most people may not read their insurance policy in detail before signing up, be sure you get answers to any questions you have upfront so you can feel confident about your purchase. Check the jewelry insurance reviews online to see what customers say, and choose the policy that offers the most complete protection for your needs without breaking your budget.

To choose the best jewelry insurance companies, The Groom Club editors evaluated insurance providers that sell coverage nationwide. We focused on insurance companies that specialize in jewelry coverage with a separate stand alone policy while including a few more general insurance companies that offer jewelry coverage under a floater or rider usually associated with a homeowners policy.

Our evaluation also relied on independent expert sources and ratings from web sites, including financial sites Wall Street Journal, Nerd Wallet, Investopedia, and Benzinga, along with jewelry focused sites such as the International Gem Society, as well as wedding and lifestyle sites including Brides and Martha Stewart.