You’ve just spent a fortune on a gorgeous engagement ring and are probably rolling your eyes at the prospect of spending even more on engagement ring insurance. After all, you’ve got a wedding to pay for, too! Yes, we’re talking about engagement ring insurance cost, and it’s worth considering trusted providers like BriteCo.

We understand. No one ever wants to buy insurance. We can’t think of anything duller to do with your money — but trust us when we say it’s essential.

Imagine splashing out several thousand dollars on a ring only to have it stolen a week later.

You didn’t take out insurance coverage, so you’re left with only one option — purchasing a new ring out of your own pocket.

Takes the shine off the engagement, doesn’t it?

Most people assume engagement ring insurance costs are high, but we’re here to tell you otherwise. You may even be pleasantly surprised at just how affordable it is.

Here’s what you need to know.

As a rule of thumb, an engagement ring insurance policy usually costs 1%–2% of the engagement ring’s total value per year. Therefore, a ring that costs $10,000 could cost as little as $100 to insure per year. A $2,000 ring will only set you back around $20 annually. Even if you’ve gone all out and spent $50,000 on a show-stopping ring, the jewelry insurance will only cost $500–$1,000 yearly.

So, yes, affordable jewelry insurance does exist, and a jewelry insurance policy is often well worth the minimal cost.

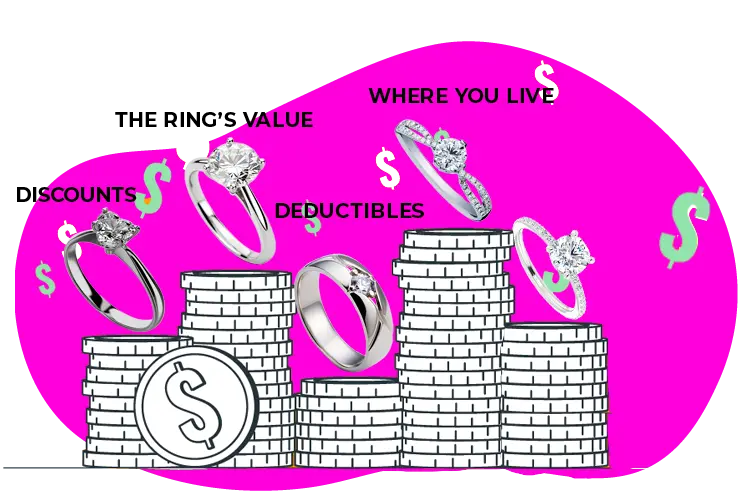

What your personal engagement ring insurance quote ends up being will depend on a few factors. Jewelry insurance companies assess your coverage application based on perceived risk, and the higher the company’s risk, the more you’ll pay for insurance.

Here’s what a jewelry insurance company considers before giving you a quote.

The engagement ring’s cost and current value will most significantly influence the quote you receive for jewelry coverage. The more expensive the ring, the more the insurance will cost.

Remember that jewelry values fluctuate, so what you paid for the ring initially might not reflect its current value. A certified appraiser can determine the ring’s current value, which may impact your coverage cost.

Your zip code plays a role in ring insurance cost. If you live in an area with a high crime rate and/or a high number of insurance claims, you will, unfortunately, pay a higher rate than someone who lives in a low crime or claim area.

Deductibles are what you are willing to pay out of pocket after a claim. The higher your policy’s deductible, the lower the cost of your coverage.

Here’s how deductibles work:

Different types of claims (theft, damage, loss, etc.) may come with different deductibles.

You’ll likely have multiple deductible options. Many insurers even offer a $0 deductible, which comes with a higher premium.

Discounts vary between insurers, but you may be able to get discounts on your jewelry insurance if you have:

Finally, some insurers do charge a minimum, such as $20 or $30. So, no matter your ring’s value, you’ll always pay at least the minimum amount for coverage.

Homeowners or renters insurance usually provides some coverage for jewelry for no extra cost. This is usually capped at $1,500 of coverage and often excludes coverage for things like accidental damage, making it not ideal for higher value rings.

You can often increase the coverage’s monetary limit for an additional cost, but the coverage itself tends to fall short.

Your insurance company may provide the option to add “floater insurance” to your homeowner’s policy. Floater insurance operates like a standalone policy but is attached to the homeowner coverage.

This costs around 1–2% of the ring’s value and offers much better coverage than what you get with the homeowner’s policy alone.

Ready to purchase engagement ring insurance? Make sure you choose the best policy for you. Here’s a quick rundown:

Include the ring on your homeowners’ insurance if:

Purchase floater insurance if:

Purchase a standalone jewelry insurance policy if:

Still not entirely sure?

Check out the best ring insurance companies on the market today. We recommend getting quotes from the insurers that fit your requirements. Don’t forget to contact your homeowner’s insurance provider and ask for a floater insurance quote, too. This will help you compare value against cost and choose the best engagement ring insurance for your needs.

All rings can be insured, no matter how much they cost. Low-value rings will tend to be covered by homeowners insurance, while higher-value rings will benefit from standalone ring insurance.

Jewelry insurance is worth it for an engagement ring. The insurer will cover the cost of replacing or repairing the ring if needed.

Ring insurance costs 1–2% of the ring’s value. Therefore, insurance for a $3,000 ring will be $30–60 per year.

Ring insurance can include coverage for loss, but it depends on which insurer and policy you choose. For example, homeowner’s insurance commonly excludes loss, while specialist ring insurance will likely include loss coverage.

You can claim a lost ring on home insurance if the policy includes loss within its coverage. To understand if your home insurance includes loss, you must consult the coverage details provided by your insurer.

When it comes to engagement bling, there’s so much to figure out. Financing the ring, what style ring to choose, and when and how you’re going to pop the question are all challenging decisions.

Luckily, all this and more is easier with The Groom Club by your side. We specialize in providing valuable information specifically for you — the groom. Be sure you never miss an article by subscribing to our newsletter.